If you employ people to provide services to customers, it’s vital to manage the hours invoiced to customers compared to those you pay to staff. Reason being, the differential is potential lost income to your business and precious profit.

It may seem like a ‘no brainer’ to say that it’s vital to sell as many hours as you can to ensure you’re making profit from the people employed to deliver services. What is not so easy though, is to measure exactly how much time is being charged to jobs and how many hours are being invoiced to customers. What typically happens is that we get focused on managing everything and caught up trying to do the best possible job for customers.

What we also need to know is where potential unbillable hours are going ... and how can we create a situation where we’re able to bill more of them.

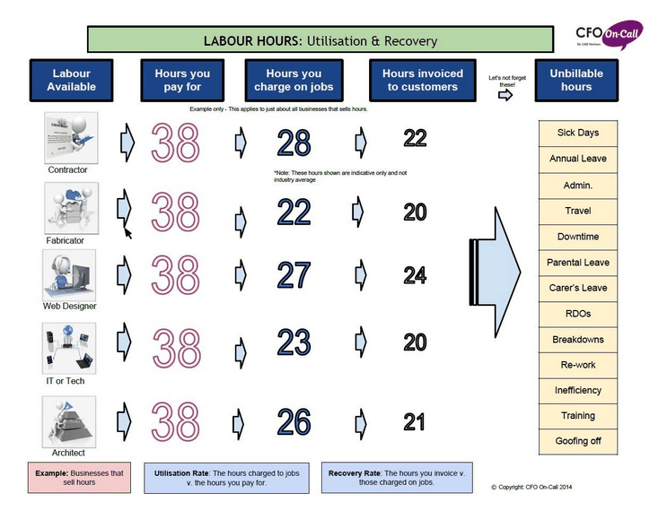

The diagram above shows:

- Standard hours (typically 38 hours per week) that you pay staff

- Hours per employee that get charged onto jobs

- Hours per employee that get invoiced to customers

The differential between these falls into many categories under the heading of ‘Unbillable hours’.

There’s a whole raft of things people can spend time doing that can’t be billed to customers. The challenge is to minimize them, where billable staff are concerned.

Firstly you need a system to keep track of hours spent on jobs and invoiced. Then you are in a position to measure productivity and take action where it falls below expectations.

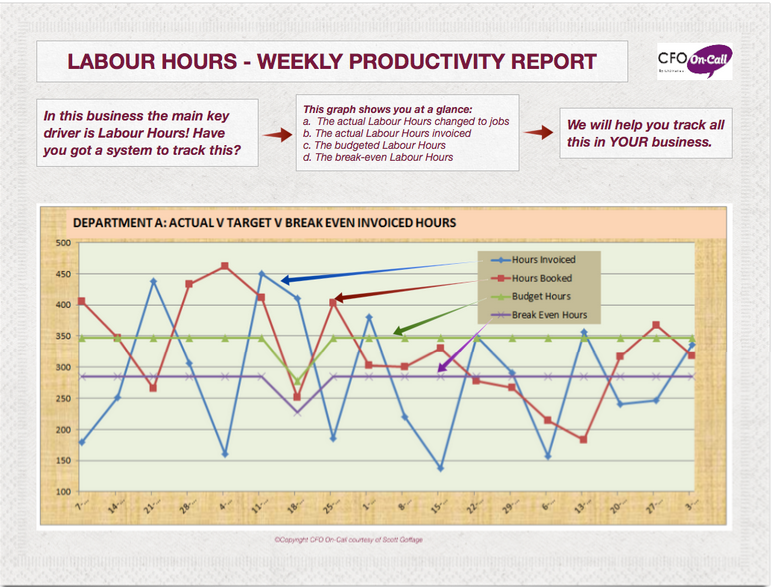

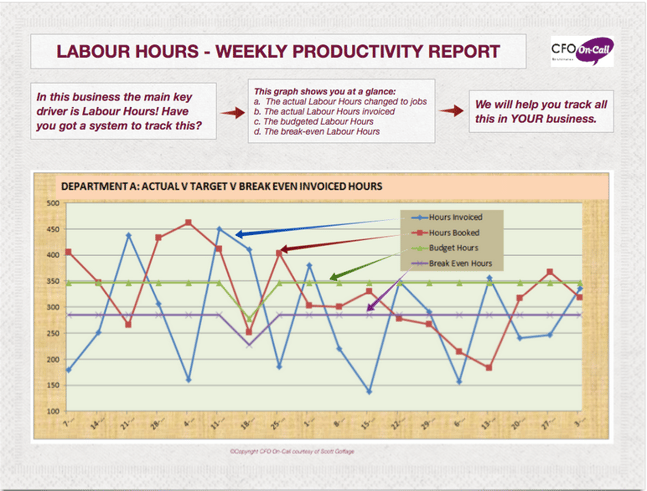

Below is a typical graphical report we provide to clients showing a comparison of:

- Hours invoiced

- Hours booked to jobs

- Budgeted hours

- Break-even hours

This report shows that for an eighteen-week period the hours booked on jobs, exceeded the hours invoiced for ten of those weeks. This means the business was paying for hours it didn’t invoice. As mentioned above this differential is potential lost income and profit.

Before you encounter this situation, what is also useful to know is ‘What If’ your staff utilization rate and/or recovery rate falls – what would be the impact on profit?

You can download a sample ‘Labour Hours – Profit Impact Calculator’ report, showing a scenario where utilization and recovery rates fall and see the exact impact on profit before it happens. That way you have a chance to do something about it and avoid losses before productivity drops.