🚀 Q1 Update 2026: How to Save 10+ Hours a Week on Project Admin

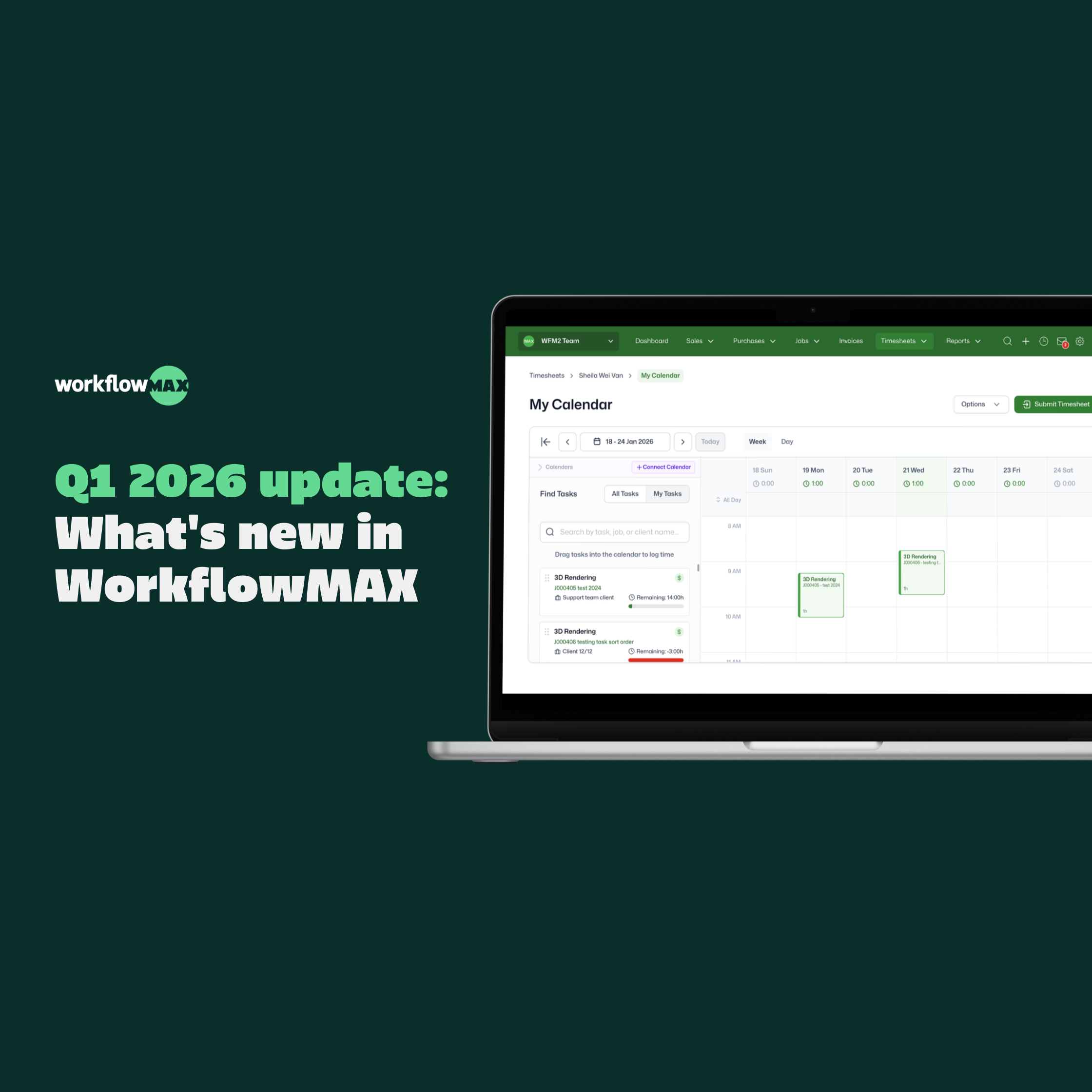

MAX Impact: Integrated Calendar turns meetings into timesheets, so billable time doesn’t get missed. Timesheet reminders and approvals automate follow-...

Read Article 4 min read

MAX Impact: Integrated Calendar turns meetings into timesheets, so billable time doesn’t get missed. Timesheet reminders and approvals automate follow-...

Read Article 4 min read

TL;DR: When firms grow, approvals often become the choke point, slowing delivery, hiding risk, and...

TL;DR: The hardest part of enterprise project governance isn’t knowing what “good” looks like, it’s...

TL;DR: The best project management software for building and construction should do one job...

TL;DR: Consulting is a business of value and time. The best project management software for...

TL;DR: For engineering firms, precision is everything. The best project management software for...

TL;DR: Creative agencies don’t usually lose money because they lack tasks. They lose money through...

TL;DR: Architecture firms don’t lose money because they “forgot a task.” They lose money because...

TL;DR: Project governance often fails because controls are added too late (or live in spreadsheets...

TL;DR: Multi-phase projects make it easy to lose financial control: budgets shift, scope expands,...

TL;DR: When multiple projects run at once, governance often breaks down in predictable ways:...

TL;DR: In growing professional services firms, approvals often break down when responsibility stays...

TL;DR: Professional services firms often avoid governance because it feels like bureaucracy, yet...